Rubber sealed deep groove ball bearings have rubber seals installed on one or both sides and are pre-lubricated with grease. These bearings often Also, snap rings are sometimes used on the outside edge. rubber sealed deep groove ball bearings with their simple design, high resistance and low-maintenance, while many different retainers are available, pressed steel cages are most commonly used.

The primary function of the seal is to protect the bearing from contaminants, it is important to keep the bearing clean when you take it out of the packaging so you don`t contaminate it just by handling it. Another function is, of course, is to make sure the bearing retains the lubricant. because of the rubber lip that`s making contact with the inner ring, we have the rubber rubbing on the inner ring of the bearing, increasing the friction in the bearing.

Our rubber sealed deep groove ball bearings use unique design polyamide and steel cage, The inner/outer rings and retainer(cage) are thicker compare with the Common bearings, stronger rivet, which consist more reliable structure. strong impact and heavy load with Grinding groove and super finishing technology. to offer the long life under extreme harsh environment.

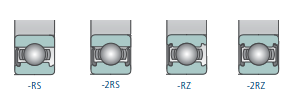

Sealed type: With one seal (-RS) on one side or two seals (-2RS) on both sides. Sealed bearings are supplied with a contacting lip seal that excels in protecting the bearing from liquids and other foreign contaminants. The inherent design creates friction, drag, and in turn heat; factors that require consideration in high speed applications.

Rubber Sealed Deep Groove Ball Bearing Rubber Sealed Ball Bearing,Rubber Sealed Deep Groove Ball Bearing,Rubber Seals Deep Groove Ball Bearing Shandong Xinkaite Bearing Co., Ltd. , http://www.conveyorbearing.com I. Industry Overview

I. Industry Overview

The auto parts industry, as the upstream industry of the auto vehicle industry, is the basis for the development of the auto industry. Its upstream industries are mainly steel, petroleum, non-ferrous metals, natural rubber, fabrics and other materials industries. The downstream industries are mainly vehicle assembly industries and Repair service industry. The development status of the auto parts industry mainly depends on the development of the downstream vehicle market and service maintenance market. In recent years, with the rapid development of the vehicle consumption market and service maintenance market, the auto parts industry in China has developed rapidly and is developing. Good, constantly transform and upgrade, and change to specialization.

According to statistics from the China Association of Automobile Manufacturers, in 2013, China's auto production and sales both exceeded 21 million, and the accumulative total production of automobiles for the year was 22,116,800, an increase of 14.76% year-on-year; sales of cars were 21,884,100, an increase of 13.87% year-on-year. In 2013, China's auto market continued its development in 2012 and maintained steady growth. The steady production and sales of autos have increased, the scale of production and sales of large enterprise groups has been promoted, and the structure of the auto industry has been further optimized.

According to data from the Ministry of Public Security’s Traffic Management Bureau, China’s vehicles maintained a rapid growth in 2013. By the end of 2013, the number of motor vehicles in China exceeded 250 million, of which 137 million were automobiles, and the amount of discarded vehicles was increased by 16.51 million. 13.7% accounted for 54.9% of all motor vehicles. There are more than 1 million cars in 31 cities across the country, of which Beijing, Tianjin, Chengdu, Shenzhen, Shanghai, Guangzhou, Suzhou, Hangzhou and other 8 cities have more than 2 million cars and Beijing has more than 5 million cars.

China’s huge vehicle consumption market and significant increase in car ownership are attracting more and more international auto parts giants into China. At present, China’s auto parts industry has formed five major sections: the Bohai Rim region, the Yangtze River Delta region, the Pearl River Delta region, the Hubei region, and the central and western regions. The entire industry is showing a rapid growth trend. The strength of some domestic auto parts companies has increased dramatically. Some companies with global competitiveness in market segments.

At the end of 2013, Roland Berger Management Consulting published the "Global Auto Parts Supplier Research Report 2013". The "Report" shows that the global auto parts supply industry is profitably stable at high levels. The data shows that the EBIT margins for both 2012 and 2013 are both 6.5%. The biggest areas of profit for suppliers are chassis, transmission systems and tires, while profits in interior trim components will shrink further. With high technological content and high profits from high added value, it stands out in the chassis, transmission system and tire industries. This means that the automobile aftermarket has a huge scale and profits continue to climb. Many products such as tires have much higher profits in the aftermarket than the vehicle market. Driven by profits, international parts and components companies such as Bosch, Denso, and China have also accelerated their presence in the Chinese aftermarket.

According to the third quarterly report of 74 parts and components companies listed in Shanghai and Shenzhen stock markets at the end of 2013, the total operating income of 74 auto parts enterprises was approximately 252.238 billion yuan, and the business income exceeding 70% was stable growth compared to the same period of last year. It can be seen that currently China's suppliers have higher profits, but there are also many challenges in the future.

Second, the development trend

1. Zero-to-zero strategic relationship Further optimization of the global automotive industry's zero-sum relationship is divided into three categories. One is the parallel development model represented by Europe and the United States. Apart from the independent vehicle companies of spare parts enterprises, the parts and components companies are free to compete; the second is the tower model represented by Japan and South Korea, and the entire vehicle and parts and components companies are interest communities, and there will be strong capital cooperation relations; It is the earliest model of China's FAW and Dongfeng Company's planned economy period. Parts are affiliated with vehicle companies. Currently, some companies in China are still in this model. However, the zero-to-zero relationship is not a constant one. Currently, European and American companies are also particularly strong in adjusting the relationship between cars and parts. In Japanese and Korean automobile companies, there is also a tendency to purchase parts globally. Nowadays, OEMs are increasingly demanding parts and components. In the future, the parts and components companies required by OEMs are not simply component suppliers in the traditional sense, but can provide system solutions to OEMs. Suppliers, in particular, have very high requirements for the integration capabilities and innovation capabilities of supplier systems. This requires parts and components companies to cooperate closely with OEMs in the early stages of advanced technology development. support. In the long-term strategy, the relationship between them is to create a future, creating a harmonious development environment and a vast space for the zero-settling enterprise.

2. The development of new energy vehicles will promote the transformation and upgrading of the auto parts industry. The Ministry of Finance and other ministries and commissions issued a joint document on February 8, 2014 to make clear that the current subsidy promotion policies will be implemented until December 31, 2015, and for 2014 and 2015. The annual allowance standard is adjusted. The central government continued to implement subsidy policies to maintain policy continuity and increase support to promote the application of new energy vehicles and promote energy conservation and emission reduction. At the same time, the Ministry of Finance recently announced the list of the second batch of cities for the promotion and application of new energy vehicles and supported the promotion and application of new energy vehicles in 12 cities or regions including Shenyang and Changchun. According to the calculation of accumulative promotion of individual cities or regions not less than 5,000 vehicles, it is estimated that the new promotion scale will be about 60,000-80,000 vehicles in the next two years. In addition, the cumulative number of the first batch of demonstration cities will reach 250,000, and the cumulative scale of new energy vehicles will exceed 300,000 in the next two years. Even considering factors such as the strength of policy implementation, it is expected that the compound growth rate of sales of new energy vehicles will still exceed 100% in the next 2-3 years. This policy will actively promote the transformation and upgrade of auto parts industry, promote the development of parts and components industry to energy-saving and environment-friendly, high-tech and high-quality, and actively promote brand strategy construction and international development.

3. Upgrading of parts and components in high-end manufacturing industries With the gradual maturity of the domestic auto market, the demand for product quality from car buyers has also increased. The main engine manufacturers have stricter requirements on the technical strength and production management capabilities of component suppliers. The implementation of policies such as the Three Guarantees Policy made the host plant and parts suppliers take more risks after the quality problems of the products. Those parts companies with stronger R&D capabilities and higher management levels will stand out from the competition. Although there is still a gap in the overall competitiveness of the domestic auto parts industry compared with the international giants, in some of the fine-grained industries, domestic parts and components companies have made breakthroughs and a broader global parts supply market has opened.

With the improvement of automotive safety, comfort and environmental protection requirements, the intelligentization of automobiles has become a major trend in the automotive industry. How to improve the safety and comfort of automobiles through electronic technologies has also become a hot spot in the industry. According to Takubo Industry Research Institute's estimates, with the maturity of 4G/LTE and cloud technologies, the global automotive electronics industry will break out this year. The output value will increase by 7% year-on-year to US$205 billion and will maintain an average growth rate of 8.5% by 2020. . At present, most of the core technologies of automotive electronics are in the hands of international giants of parts and components, and automotive electronics has become the weakest link in China's auto industry. Due to the difficulty of development and high product quality stability, most of the domestic market is occupied by foreign capital. The independent brands only occupy a place in the low-end market such as car navigation, video and audio playback.

Third, the challenges

1. The quality of China's brand auto parts needs further improvement After years of development, the quality of Chinese brand parts has greatly improved, but there is still a certain gap between the quality level of Chinese brand parts and that of foreign-funded enterprises, especially the consistency of products. The reliability needs to be further improved. Because some Chinese branded parts and components enterprises still remain in the extensive traditional management mode of production, lack of research and continuous improvement of process systems, lack of process control capability, unstable quality, poor product consistency, it is difficult to form high-quality products. In order to develop auto parts companies, in addition to fighting technological innovation, we must also devote more efforts to product quality.

Industry development, standards first, auto parts industry standards continue to improve in recent years, allowing people to see the industry's healthy and orderly development of hope. Many favorable policies introduced in 2013 are also strongly promoting the development of auto parts remanufacturing. On August 26, 2013, five ministries and commissions released the "Re-manufactured Products" implementation plan for the "old-for-for-new" pilot program, announcing the launch of an "old-for-used" pilot project, which will include remanufactured engines and transmissions as key projects. On September 16th, the "Beijing-Tibet Line" of automobile parts remanufacturing departed and passed the actual road test to inspect the quality of parts and remanufactured products. On November 21, the Ministry of Industry and Information Technology issued the “Recommissioning Plan for Internal Combustion Enginesâ€. At the same time, a number of standards for the auto parts industry in 2013 were issued or designated. On March 1, National Standards for Performance Requirements and Test Methods for Passenger Vehicle Tyre Pressure Monitoring System (TPMS) was publicly solicited for comments. In addition, the national standard for airbags has been basically completed and the mandatory standards for air quality in cars will be implemented in 2015.

2. Domestic auto parts companies need to further enhance the core technical product technical strength is the core element of enterprises participating in the market competition. The strength of foreign parts companies comes from the huge amount of R&D investment and continuous technological innovation. Domestic enterprises have always lacked in this respect. At present, domestic auto parts suppliers generally adopt the “to map processing†model, that is, auto manufacturers provide product data and drawings to suppliers, and the latter manufactures according to drawings. Most companies do not have complete products to master core technologies, and most of their product markets are medium- and low-end, and there are few high-end products. In terms of automotive electronic control technologies, they are particularly involved in the technical backwardness of power systems, fuel consumption, emissions, safety, and other electronically controlled parts. Field blank. Faced with the trend of diversified development of automobile energy in the future, and increasingly strict requirements for energy conservation, environmental protection, and safety, it is required that parts and components companies not only have basic development capabilities, but also have advanced technology development capabilities. For this reason, the technology development capabilities of parts and components companies will be more tested.

However, as the competition in the auto parts market has intensified, domestic parts and components companies have gradually increased their R&D investment in new products and technologies. According to data on R&D investment in the 2012 annual report of the top 30 companies listed in the China Automotive News, the average ratio of R&D input to operating income was 2.70%, and the average amount of input was 244 million yuan. . Among them, the research and development investment of Weichai Power [-2.16% Capital Research Report] accounted for 4.14% of the operating revenue, with a total amount of 1.996 billion yuan. Yunnei Power [1.07% Fund Research Report] 2012 R&D investment increased by 22.15% compared to the same period of last year. It also increased investment in R&D projects such as the “D25TCI Electronic Control Common Rail Project†and “Euro 5 Diesel Engine Developmentâ€. The direct result of the increase in R&D investment is that in recent years, many new technologies and products have emerged in the auto parts industry, such as in-cylinder direct injection technology, electronically controlled high-pressure common rail technology, and dual-clutch transmission technology, in recent years. Turbocharging technology has also been continuously improved.

China's auto industry is in an important period of development. Building a powerful automobile country will rise to become a national development strategy. Green, environmental protection, high efficiency, and safety are trends in the development of the automotive industry. In order to realize the transformation, upgrade and development of the automotive industry and improve the overall level of development of the automotive industry, China has proposed to vigorously develop the energy-saving and new energy automotive industry. China's auto parts industry must coordinate the development of the entire automobile industry. In the near future, it will focus on parts development strategy, transformation and upgrading, policy research, technological innovation, standards and regulations, zero-sum cooperation, common platform construction, industry internationalization, and industry. Cluster development and operational services and other efforts.